Answer:

$20,900

Explanation:

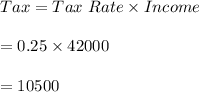

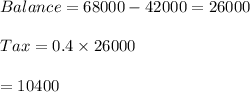

-The income tax is 25% on first $42,000 and 40% on all amounts greater than $42000

#Tax on first $42,000:

#Tax on the income balance will be:

Total income tax=10400+10500=$20,900

Hence, the proposed income tax will be $20,900