Answer:

Step-by-step explanation:

Year 1: Dividend, D1 = $2.73

Year 2: Dividend, D2 = $3.06

Year 2: Stock Price, P2 = $53.83

Cost of Capital, r = 8.6% = 0.086

(a.)

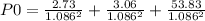

let Current Price = Po = D1/(1 + r)² + D2/(1 + r)² + P2/(1 + r)²

Current Price, Po = $50.75

(b.)

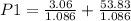

let Year 1 stock price = P1 = D2/(1 + r) + P2/(1 + r)

Stock Price Year 1, P1 = $52.38

(c.)

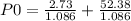

price am Willing to pay, Po = D1/(1 + r) + P1/(1 + r)

Current Price, P0 = $50.75

The part c is almost the same as part a answer