Answer:

- Monthly Payment for Choice 1=$665.16

- Monthly Payment for Choice 2=$627.10

- Total Closing Cost for Choice 1=$241557.60

- Total Closing Cost for Choice 2=$233456

- (A)Choice 1 be the better choice the monthly payment is higher.

- (D)Choice 2 be the better choice because the monthly payment is lower.

Step-by-step explanation:

Amount of Loan needed = $140,000

- A point is an optional fee which helps you get a lower interest rate on your loan.

- Closing costs are the fees you pay when obtaining your loan.

Choice 1

30-year fixed rate at 4% with closing costs of $2100 and no points.

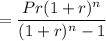

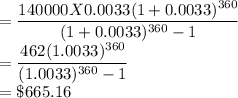

Monthly Payment

P=$140,000

Monthly Rate=4% ÷ 12=0.04 ÷ 12=0.0033

n=12 X 30 =360

Monthly Payment=$665.16

Total Closing Cost =(665.16 X 360)+2100=$241557.60

Choice 2

30-year fixed rate at 3.5% with closing costs of $2100 and 4 points.

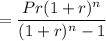

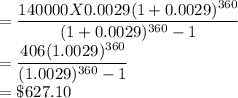

Monthly Payment

P=$140,000

Monthly Rate=3.5% ÷ 12=0.035 ÷ 12=0.0029

n=12 X 30 =360

Monthly Payment=$627.10

Total Closing Cost =(627.10 X 360)+2100+(4% of 140000)=$233456