Answer:

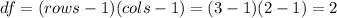

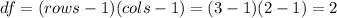

Now we can calculate the degrees of freedom for the statistic given by:

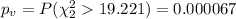

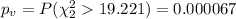

And we can calculate the p value given by:

And we can find the p value using the following excel code:

"=1-CHISQ.DIST(19.221,2,TRUE)"

Since the p values is higher than a significance level for example

, we can reject the null hypothesis at 5% of significance, and we can conclude that the two variables are dependent at 5% of significance.

, we can reject the null hypothesis at 5% of significance, and we can conclude that the two variables are dependent at 5% of significance.

Explanation:

Previous concepts

A chi-square goodness of fit test "determines if a sample data matches a population".

A chi-square test for independence "compares two variables in a contingency table to see if they are related. In a more general sense, it tests to see whether distributions of categorical variables differ from each another".

Solution to the problem

Assume the following dataset:

Size Company/ Heal. Ins. Yes No Total

Small 32 18 50

Medium 68 7 75

Large 89 11 100

_____________________________________

Total 189 36 225

We need to conduct a chi square test in order to check the following hypothesis:

H0: independence between heath insurance coverage and size of the company

H1: NO independence between heath insurance coverage and size of the company

The statistic to check the hypothesis is given by:

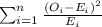

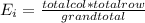

The table given represent the observed values, we just need to calculate the expected values with the following formula

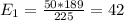

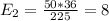

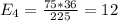

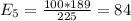

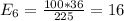

And the calculations are given by:

And the expected values are given by:

Size Company/ Heal. Ins. Yes No Total

Small 42 8 50

Medium 63 12 75

Large 84 16 100

_____________________________________

Total 189 36 225

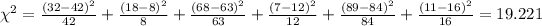

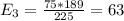

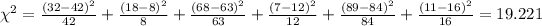

And now we can calculate the statistic:

Now we can calculate the degrees of freedom for the statistic given by:

And we can calculate the p value given by:

And we can find the p value using the following excel code:

"=1-CHISQ.DIST(19.221,2,TRUE)"

Since the p values is higher than a significance level for example

, we can reject the null hypothesis at 5% of significance, and we can conclude that the two variables are dependent at 5% of significance.

, we can reject the null hypothesis at 5% of significance, and we can conclude that the two variables are dependent at 5% of significance.