Answer:

The money that must be deposited to the fund now to just deplete the fund after the last withdrawal is $34,428.

Step-by-step explanation:

This is a case of decreasing annuity, in which every year is decreased a fixed ammount. In this case, the decrease does not have a constant rate, so the formula for a increasing (or decreasing) annuity is not applicable.

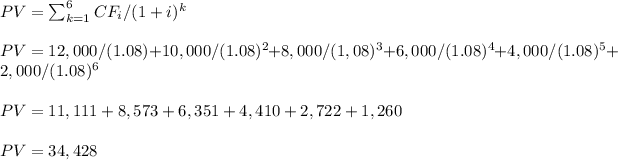

We have to calculate the present value in a traditional way: