Final answer:

The firm's levered value after issuing $200,000 of perpetual debt and considering the tax shield and PV of financial distress is $820,000.

Step-by-step explanation:

Calculation of Firm's Levered Value

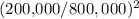

To calculate the firm's levered value, we must consider both the tax shield from debt and the present value (PV) of financial distress costs. The firm's unlevered value (V*) is $800,000 and it plans to issue $200,000 of perpetual debt. The corporate tax rate is 35%, creating a tax shield on the debt. Additionally, the PV of financial distress as a function of the debt ratio (D/V*) is given by the formula: 800,000 × (

).

).

First, we calculate the tax shield as follows:

Tax Shield = Debt × Tax Rate = $200,000 × 35% = $70,000.

Next, we calculate the PV of financial distress:

PV of Financial Distress = 800,000 × (

) = 800,000 × (

) = 800,000 × (

) = 800,000 × 0.0625 = $50,000.

) = 800,000 × 0.0625 = $50,000.

Finally, we determine the levered value (V) by adding the tax shield to the unlevered value and then subtracting the PV of financial distress:

Levered Value = V* + Tax Shield - PV of Financial Distress = $800,000 + $70,000 - $50,000 = $820,000.

The firm's levered value after issuing $200,000 of debt to buy back stock is $820,000.