Answer:

a A=$47,887.81

b.A=$46,430.80

Explanation:

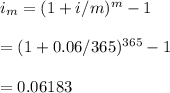

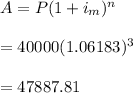

a. Given the initial amount is $40,000 with a 3-year term and a 6% rate compounded daily.

-Take 1 year=365 days

#First we calculate the effective interest rate corresponding to the daily compounding;

#We use the calculated effective rate, 0.06183, to solve for the future value as:

Hence, the total future value for a daily compounding is $47,887.81

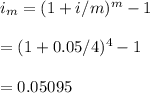

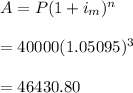

b. For a sinking fund with a 5% compounded quarterly:

#We calculate the annual effective rate:

#We use the calculated effective rate, 0.05095, to solve for the future value as:

Hence, the future value of the sinking fund is $46,430.80