Answer:

Step-by-step explanation:

First of all, as the interest is paid semi-annually, we calculate semi-annual interest rate by dividing yield to maturity by the number of periods in a year (2).

Semi-annual interest rate = 0.0818 / 2 = 0.0409

Now using the following formula

![YTM\;=\;\sqrt[n]{(Face\;Value)/(Current\;Price)}\;-\;1](https://img.qammunity.org/2021/formulas/business/college/j24xwpd2eq0spbyesisrythmjpq5cg5a3p.png)

where,

YTM = 0.0409 (semi-annually)

Face Value = $1000

Current Price = $823.5

n = Number of semi-annual periods

![0.0409\;=\;\sqrt[n]{(1000)/(823.5)}\;-\;1\\\\0.0409\;+\;1=\;\sqrt[n]{{1.214}}\\\\1.0409^(n) =\;1.214\\\\](https://img.qammunity.org/2021/formulas/business/college/6s55vqbivxcc97rzt2sh43izy67dttfcre.png)

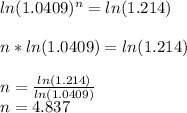

Taking natural log on both sides,

Hence, semi-annual periods are 4.837. Therefore, the bond will mature in approximately (4.837/2) 2.4185 years.