Solution and Explanation:

The Journal Entries in the books of Brock's water enterprise is as follows :-

Date Particulars and details Debit($) Credit($)

Jan 5, 2018 Intangible Assets - Lease 905861

Lease Payable 905861

(Being Record the Lease)

Jan 5, 2018 Lease Payable 125000

Cash 125000

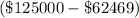

(Being Record Down Payment)

Dec 31, 2018 Amortization Expenses ($905861divide 10) 90586

Accumulated Amortization 90586

(Being Record the amortization)

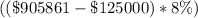

Jan 5, 2019 Lease Payable

62531

62531

Interest Expenses

62469

62469

Cash 125000

(Being Record the Second Lease Payment)