Answer:

The correct answer is 8.679%.

Step-by-step explanation:

According to the scenario, the given data are as follows:

Face value (F) = $1,000

Bond value (B)= $955

Time (t) = 18 years

Yield (r) = 9.2%

First we calculate the coupon payment:

Let coupon payment = C

then,

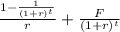

B = C ×

By putting the value, we get

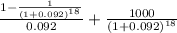

$955 = C×

$955 = C × 8.64 + 205.11

C = 86.79

So, Coupon Rate = Coupon Payment ÷ Face value

= 86.79 ÷ 1000

= 0.08679

= 8.679%