Answer:

The Annual Percentage Rate (APR) on a credit card directs the intrigue that you will pay while conveying an equalization from month to month. You won't bring about intrigue on the off chance that you cover your tab in full each month and along these lines keep up your elegance period. This gives you in any event 21 days from when your announcement opens up to take care of your tab before the installment is viewed as late.

Credit card intrigue is evaluated consistently. This implies a credit card organization will decide the amount to charge you on a given day by duplicating the equalization toward the finish of that day by your APR/365. These intrigue charges will at that point become some portion of your parity the following day and will themselves bring about intrigue. The procedure of enthusiasm bringing about intrigue is known as intensifying.

Step-by-step explanation:

An annual percentage rate (APR) is the annual rate charged for obtaining or earned through a venture. APR is communicated as a percentage that speaks to the real yearly expense of assets over the term of a credit. This incorporates any charges or extra expenses related with the exchange however don't consider. As advances or credit understandings can change regarding loan fee structure, exchange expenses, late punishments, and different components, an institutionalized calculation, for example, the APR furnishes borrowers with a main concern number they can without much of a stretch contrast with rates charged by different moneylenders.

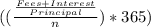

APR =

Where:

Interest = Total interest paid over life of the loan

Principal = Loan amount

n = Number of days in loan term

A credit card is a slight rectangular section of plastic gave by a budgetary organization, that lets cardholders acquire assets with which to pay for merchandise and ventures. Credit cards force the condition that cardholders take care of the obtained cash, in addition to enthusiasm, just as any extra settled upon charges. The credit organization supplier may likewise concede a credit extension (LOC) to cardholders, empowering them to get cash as loans. Guarantors generally pre-set acquiring limits, in view of a person's credit rating. A greater part of organizations let the client make buys with credit cards, which stay one of the present most well known installment strategies for purchasing purchaser merchandise and ventures.