Answer:

The future value of an annuity (FVA) is $828.06

Step-by-step explanation:

The future value of an annuity (FVA) is the value of payments at a specific date in the future based on the payments being recurring and assuming a discount rate. The future value of an annuity (FVA) is based on regular cash flow. The higher the discount rate, the greater the annuity's future value.

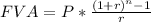

Where:

FVA is The future value of an annuity (FVA)

P is payment per period

n is the number of period

r is the discount rate

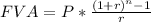

Given that:

P = $195

r = 4% = 0.04

n = 4 years

substituting values

The future value of an annuity (FVA) is $828.06