Answer:

Safest Investment: Third company Biotech firm

Riskiest Investment :first company Software company.

Highest Return: 2nd company Hardware company.

Explanation:

Given:

3 investors with values as :

1) Software company:

10% on 5 million dollars ( gaining),30% on 1 million dollar(gaining) and 60 % on 1 million dollar (losing )

2)Hardware company

20% on 3 million dollar(gaining) ,40 % on 1 million dollar(gaining) ,40 % on 1 million dollar(losing)

3) Biotech firm

10 % on 6 million dollar (gaining),20% on 1 million dollar(losing)

To find:

Using variance which investment is safe and risk.

Solution:

variance defines a function values how data is spread across the mean value for variance wide range across the mean which indicates risk factor is more in that c.ase

Variance is calculating by using the formula as

Variance= the sum of X values squared divided by the number of values N minus the mean of X values squared.

for calculate expected value 1st gives the average of the company,

For company

Expected value=(probability of profit *cost of profit) -(probability of losing *cost of losing).

For software company

1)E(x)=10%*5 million+1million*30% - 1million*60%)

=200000 dollars.

2)E(x)=20%*3million+40%*1 million - 40% *1million

=600000 dollars.

3)E(x)=10% *6 million-20%*1 million........(70 % is no loss no gain its value will be 0)

=400000 dollars.

No of observation or rounds are

for software 2 profit 1 loss n=3

for hardware 2 profit 1 loss n=3

For biotech firm 1 loss 1 profit n=2.

Mean value for investment will be μ,

as μ=E(x)/n

For

1) μ=E(x)/n=2,00,00/30=66,666.67 dollars.

2) μ=E(x)/n=6,00,000/3=200000 dollars.

3) μ=E(x)/n =4,00,000/2=200,000 dollars.

For variance we required μ^2 so............(EQUATION 1st)

For 1st company,

μ^2=66,666.67^2=4.44*10^9

For 2nd company

μ^2=200000^2=4*10^10

For 3 company

μ^2=200000^2=4*10^10

Now calculating the

Each term square and add them up

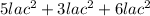

For company 1st

Each terms are 5 lac ,3 lac and 1 lac

Add their square values first as follows and repeat same process for other 2 company.

for 1st=

=

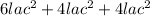

For 2nd one,

=

=6.6 *10^11

For 3 rd one ,

=

=4*10^11.

further divide these values by "n"we get,................(EQUATION 2nd)

For 1st company,

=(7*10^11)/3

=2.33*10^11

For 2nd company,

=(6.6*10^11)/3

=2.2*10^11

For 3rd company ,

=(4*10^11)/2

=2*10^11.

To get variance Subtract equation 2 and 1 ,

For 1st company

Variance=2.33*10^11-0.044*10^11

=2.289*10^11

For 2nd company

variance=2.2*10^11- 0.4*10^11

=1.8*10^11

For 3rd company

variance=2*10^11-0.4*10^11

=1.6 *10^11.

Hence we can conclude that , by definition of variance,

- The safest invest will be Third investment Biotech firm because the variance value is low as compared to other 2 values

- The risk investment will be first investment Software company because variance value is more as compare to other 2.

- Using Expected value , the 2 investment i,Hardware company will return more .