Answer:

$1.81

Step-by-step explanation:

Applying the Non constant growth formula and the Gordon's model

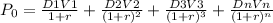

The Non constant growth formula :

D1V1 = dividend in year 1

D2V2 = dividend in year 2

r = discount rate

Po = price of stock at year 0

Pn = price of stock year n

therefore to get the stock price at year 0 and year 1 we will apply the above formula + the Gordon model formula

stock price year 0 = ($2.40 / 1.15) + ($2.88 / 1.15²) + ($3.456 / 1.15³) +[$4.1472 / (15% - 4%)] / 1.15⁴ = $2.09 + $2.18 + $2.27 + $21.55 = $28.09

stock price year 1 = ($2.88 / 1.15) + ($3.456 / 1.15²) +[$4.1472 / (15% - 4%)] / 1.15³ = $2.50 + $2.61 + $24.79 = $29.90

therefore the capital gain between year 0 and year 1

= P1( price of stock at year 1)- Po (price of stock at year 0)= $29.90 - $28.09 = $1.81