Answer:

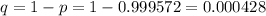

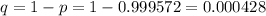

The probability of no survive by the complement rule is

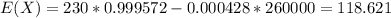

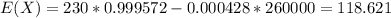

And the expected value would be given by:

So then the company would expect a net amount of 118.621 for the insurance.

Step-by-step explanation:

Previous concepts

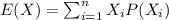

The expected value of a random variable X is the n-th moment about zero of a probability density function f(x) if X is continuous, or the weighted average for a discrete probability distribution, if X is discrete.

The expected value is defined by this formula:

Where

represent the possible values for the random variable and

represent the possible values for the random variable and

the corresponding probabilities.

the corresponding probabilities.

Solution to the problem

For this case we define X a random variable who represent the net amount of money for the company.

The probability of no survive by the complement rule is

And the expected value would be given by:

So then the company would expect a net amount of 118.621 for the insurance.