Answer:

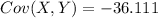

a) The correlation coeffcient is given by:

And replacing we got:

b) For this case we can conclude that we have a strong, negative linear association between the two stock prices.

Step-by-step explanation:

Part a

For this case we have the following info:

represent the sample deviation for the variable X

represent the sample deviation for the variable X

represent the sample deviation for the variable Y

represent the sample deviation for the variable Y

represent the covariance between the variables X and Y

represent the covariance between the variables X and Y

The correlation coeffcient is given by:

And replacing we got:

Part b

Describe the relationship between prices of these two stocks.

For this case we can conclude that we have a strong, negative linear association between the two stock prices.