Answer:

IRR is 3%. Reject the project.

Step-by-step explanation:

Given: Investment= $238160.

Cash flow= $52000

Time period= 5 years

Cost of capital= 6%.

Now, finding IRR for the investment to be made on a new marketing campaign.

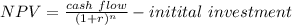

Formula;

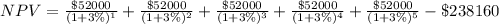

Assuming at IRR approximately 3% we will have zero NPV

⇒

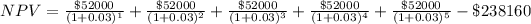

⇒

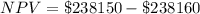

⇒

∴ At IRR 3% company is almost close to equal of investment amount $238160, however the cost of capital to the firm is 6% in next five year, which will cause loss to the firm. Hence, project is rejected.