Answer:

We get that option (1) is a better 18th Birthday gift of child by Grandfather.

Explanation:

Given that,

Amount deposited in bank at time of birth by Grandfather is $100.

And there is no other deposits and withdrawals for 18 years.

So,

Principal amount =$100

Time = 18 years

Rate of interest of bank = 10.5%

Option 1:- An account That grows by 10.5% each year

we know that Bank give compound interest on the deposit amount

then Compound interest =

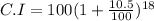

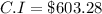

∴

Option 2:- An account that grows by $20 each year

Here,

Amount credited in account for 18 years = $20

So, Total amount after completion of 18 years =

=

Hence,

We get that option (1) is a better 18th Birthday gift of child by Grandfather.