Answer:

a) CM1 = 25

CM2 = 40

b) CMmh1 = 25

CMmh2 = 20

c) 25,000 units of Vase 1 and 12,500 units of Vase 2

d) OI = $ 525,000

Step-by-step explanation:

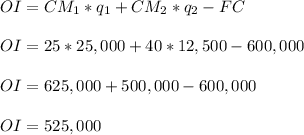

a. Determine the contribution margin per unit for each type of vase.

The contribution margin per unit is equal to the difference between the sale price and the variable cost per unit:

b. Determine the contribution margin per machine hour for each type of vase.

For the Vase 1, the number of machine hours per unit is 1. So the contribution margin per machine hour for Vase 1 is equal to CM1=$25.

For the Vase 2, the number of machine hours per unit is 2. Then, the contribution margin per machine hour for Vase 2 is equal to CM2=$40/2=$20.

c. Determine the number of units of each style of vase that Rose Incorporated should produce to maximize operating income.

There are 3 restrictions:

- Max 25,000 units of Vase 1

- Max 25,000 units of Vase 2

- 50,000 hours of machine hour

As the contribution margin per machine hour is higher for the Vase 1, so we start producing the more we can of Vase 1. The limit is 25,000 units.

Then, we are left with 25,000 machine hours available for Vase 2. We can produce 25,000/2=12,500 units, which is under the market constraint.

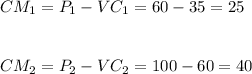

d. What is the dollar amount of the maximum operating income as calculated in C above

The operating income for the mix proposed in C is: