Answer:

Therefore the annual rate of growth 9%.

Step-by-step explanation:

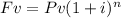

To find the annual rate, we use the following formula,

Fv= future value

Pv= present value.

i= rate of interest

n= time.

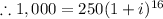

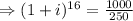

Here Pv=$250, Fv= $1,000, n= 16 years

(approx)

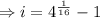

(approx)

Therefore the annual rate of growth 9%.