Answer:

a) 4.800 units: Operational loss area (L)

12,000: Break even point (BEP)

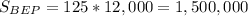

$1,500,000: BEP

20,000 units: Operational profit area (P). Also, the maximum amount of units.

$2,500,000: Operational profit area (P). Also, the maximum amount of sales.

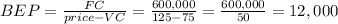

b) BEP: 12,000 units or $1,500,000 in sales.

Step-by-step explanation:

The graph is divided in two sections:

1 - The operational loss area (L)

2 - The operational profit area (P)

The interface between both regions is the breakeven point.

a) 4.800 units: Operational loss area (L)

12,000: Break even point (BEP)

$1,500,000: BEP

20,000 units: Operational profit area (P). Also, the maximum amount of units.

$2,500,000: Operational profit area (P). Also, the maximum amount of sales.

b) The breakeven point is where sales equal total cost (or the level at which profits are zero). This breakeven point (BEP) is at 12,000 units:

This corresponds to $1,500,000 in sales.