Answer:

Current Value = $31.50

Step-by-step explanation:

The stock price formula in general is:

Where

P is the stock price

D is the dividend

g is the growth rate, discount rate

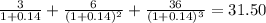

Now, we have to find the sum of all the prices in each year:

Current Value = $31.50