Answer:

See Below

Step-by-step explanation:

We can use the future price formula here, which is:

Where

F is the theoretical future price

P is the present index standing

r_f is the risk free rate

d_y is the dividend yield

n is the number of months of the futures deliverable

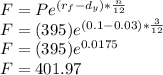

Now,

given

P = 395

r_f = 0.1

d_y = 0.03

n = 3

Substituting, we get:

Actual future price is 404. The index future price is higher. So the strategy would be to sell the futures contracts. Long the shares underlying the index.