Answer:

Estimated current stock price is $46.84

Explanation:

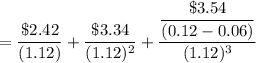

First we have to find the value of dividend payment

Given

Yearly growth rate for next 2 years(

)=38.00%

)=38.00%

Growth after two years will 6% indefinitely

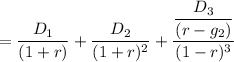

Estimate of current stock price is

=$46.84

Estimate of current stock price is =$46.84