Answer:

$16 ( g )

Step-by-step explanation:

Dividend expected after 1st year = $2.2

required return on investment =10%

dividend expected in 2 years = $2.4

stock price at the end of 2 years = $14.60

discount factor = 1.1 since required return on investment = 10%

To calculate the value of the stock

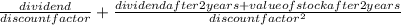

value of stock =

value of stock =

= 2 + 14.049

= $16.05