Solution and Explanation:

EOY BTCF Deprec Taxable income Income Tax ATCF

0 -85000 0 0 0 -85000

1 34000 21250 12750 5738 28263

2 34000 21250 12750 5738 28263

3 34000 21250 12750 5738 28263

4 34000 21250 12750 5738 28263

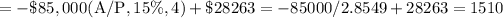

The after-tax AW

The annual equivalent worth of the ATCFs is equals

The annual equivalent EVA. The after-tax annual worth and the annual equivalent worth of EVA of the project are identical.

therefore, the EVA = 1510