Answer:

Growth Rate = 5.73%

Step-by-step explanation:

The present value of stock formula can be used here to solve this problem.

The formula is:

Where

is the current stock price

is the current stock price

is the dividend to be paid next year

is the dividend to be paid next year

r is the rate of return required

g is the growth rate expected

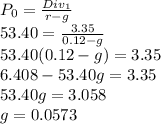

Now, the first 3 variables are given, we need to find g. Substituting, we find our answer:

In percentage, it is

Growth Rate = 5.73%