Solution and Explanation:

The following formulas will be used in order to calculate the accounts receivable turnover ratio and in order to find out the number of days collect.

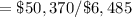

Accounts receivable turnover ratio = Net sales divided by Average net Accounts receivable

![=\$ 50,370 /[(\$ 7,250+\$ 5,720) / 2]](https://img.qammunity.org/2021/formulas/business/college/ovioizweqegmcz2v16wc0eh7a4y8vnw64q.png)

= 7.77 times

Days to collect = 365 divided by Accounts receivable turnover ratio

= $365 divided by 7.77

= 47 days

Note: The number of days that has been assumed is 365 days