$2100 million is the correct

Step-by-step explanation:

Given data :

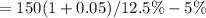

Cash flow given = 150 million, growth rate = 5% constant, weighted average cost of capital = 12.5%

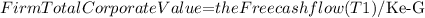

The calculation of the firm’s total corporate value is as follows by using the formula:

= 2100 million

Where: Ke = cost of capital

Thus, from the given options, $2100 million is the correct answer