Answer:

$2080

Step-by-step explanation:

Given: Cost of generator= $11000.

Residual value= $1000.

Estimated life of generator= 5000 hours.

Actual activity performed during the period= 1040 hours.

Now, finding the depreciation expense for the first year using the units-of-activity method.

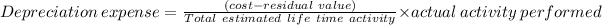

Formula;

⇒ Depreciation expense=

Opening parenthesis

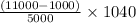

⇒ Depreciation expense=

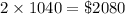

⇒ Depreciation expense=

Hence, the depreciation expense for the first year using the units-of-activity method of depreciation is $2080.