Answer:

Accorsi & Sons will have to identify each obligation’s share of the sum of the stand-alone selling prices of all performance obligations:

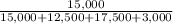

Projector:

*100 = 31.25%

*100 = 31.25%

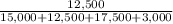

Surround speakers:

*100 = 26.04%

*100 = 26.04%

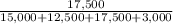

Leather seats:

*100 = 36.46%

*100 = 36.46%

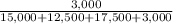

Installation service:

*100 = 6.25%

*100 = 6.25%

Accorsi & Sons would allocate the total selling price of $33,500 based on the stand-alone selling prices, as shown below:

Projector: $33,500 × 31.25% = $10,468.75

Surround speakers: $33,500 × 26.04% = $8,723.40

Leather seats: $33,500 × 36.46% = $12,214.10

Installation service: $33,500 × 6.25% = $2,093.75

Total: $10,468.75 + $8,723.40 + $12,214.10 + $2,093.75 = $32,500 = 100%