Answer:

discount , 10.81%

Step-by-step explanation:

Given : Spot Rate of the currency = $0.37

90 day Forward Rate = $0.36

A premium or a discount on a currency is given by the following equation:

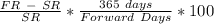

=

wherein, FR = Forward Rate of a currency

SR = Spot Rate of a currency

Forward days= Forward period

In the given case, premium or discount can be calculated, by putting the values in the above equation. We have,

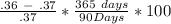

=

= - 10.81 %

the negative sign denotes a forward discount