$3900 is deductible casualty loss

Step-by-step explanation:

The following formula is used in order to calculate the deductible casualty loss

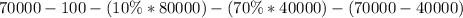

Deductible casualty loss = Amount of loss-$100 for each event-(10%*AGI)-amt reimbursed by insurance company-(Fair value of cabin-cost of repairing)

=

After calcuating we get, $3900

Thus, $3900 is the correct answer.

To qualify as a loss misfortune, the harm, obliteration or loss of property must emerge from an abrupt, surprising and abnormal occasion, similar to a flood, tropical storm, tornado, fire, tremor or volcanic ejection. You may take a derivation for deductible loss misfortunes just to the degree that the misfortune isn't secured by protection.

Along these lines, if the misfortune is completely secured, you'll get no reasoning. Besides, the individual finding for setback misfortunes to the individual property is seriously restricted: You can deduct just the measure of all your loss misfortunes for the year that surpass 10% of your balanced gross pay for the year.