Solution and Explanation:

Answer a The following formula will be used to calculate the return on the equity.

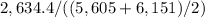

Return on equity = Net income divide by Average equity The return on equity is equal to

Thus, return on equity is equal to 44.82% Answer b Correct answer is the option: ROE usually increases since the repurchase of shares reduces the denominator (avg. stockholders' equity)

Thus, return on equity is equal to 44.82% Answer b Correct answer is the option: ROE usually increases since the repurchase of shares reduces the denominator (avg. stockholders' equity)

Answer c Correct answer is the option: Companies repurchase their own stock if they feel it undervalued by the market.