Solution and explanantion

To record the assignment of overhead to the assembly and finishing department, debit the work in process assembly department, debit the work in process finishing department and credit manufacturing overhead as below:

date Particulars Debit Credit

Work in process – assembly department 71040

Work in process – finishing department 29440

Manufacturing department 100480

Working note:

Labor cost assigned to assembly = $44400

Labor cost assigned to finishing = $62800 minus 44400 = $18400

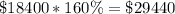

Manufacturing overhead assigned to assembly =

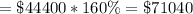

Manufacturing overhead assigned to fiishing =