Answer:

12.73%

Explanation:

Given the annual rate is 12% compounded weekly.

Let's assume 1 yr=52weeks.

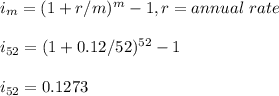

The effective interest rate is calculated as:

Hence, the effective rate for 12% compounded weekly is 12.73%

-The effective rate will be different when the number of compounding times is less than or more than 1 year.

- the effective rate is equal to the stated rate if the compounding number of times is once per year.