Solution and Explanation:

The US investor is Investing in German bond and he is also hedging for the protection against the exchange rate fluctuations

So we have two types of gain, One due to bond and one due to hedging

Part B)

Gain on Bond:

Interest gain = 1% [ 4% per annum ]

Gain due to price change = 3%

Total gain = 3% plus 1% = 4%

These all are in Euro if and the dollar has depreciated so actual gain in USD

Earlier Exchange rate = 0.94

Exchange rate Now = 0.85

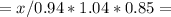

Let the investor invested X USD , Convert this into Euro

X USD = X divided by 0.94 EURO

Gain on this is 4% in euro terms, So after 3 months X/0.94 becomes X/0.94 *1.04

Now we will convert this to USD based on current exchange rate so present value

0.9404X

0.9404X

So loss = X minus 0.9404X = 0.05957 = 5.957%

Part A )

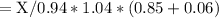

Now, we can see the gain by hedging

We have gain of 0.91 minus 0.85 = 0.06 Euro / Dollar

So , we can add this gain to the current spot rate as effective rate will be spot + gain due to forward

Now we will convert this to USD based on current exchange rate so present value

= 1.0068X

= 1.0068X

Profit = 1.0068X minus X = = 0.681%