Answer:

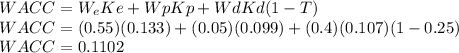

WACC = 11.02%

Step-by-step explanation:

Since it is going to use "retained earnings" to source common equity, we take cost of equity to be 13.3% NOT 13.9% for new equity, because they are going to use retained earnings.

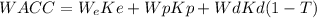

The Weighted Average Cost of Capital (WACC) formula is:

The W's are the respective weights of equity, preferred stock, and debt in the portfolio

The K's are the cost of each respectively

T is the tax rate

We are given the information, we simply plug them into the formula and find the WACC. Shown below:

Converting to percentage,

WACC = 0.1102 * 100 = 11.02%