Answer:

degree of operating R = 1.25

degree of financial = 1.51

total leverage for firm R = 1.88

degree of operating W = −4.98

degree of financial W = 13.05

total leverage for firm W = −64.989

Finance risk is more for Firm W as it has more interest to pay

Leverage is the use of fixed costs in a company’s cost structure.

Step-by-step explanation:

given data

R sales = 103,000 units

sales cost = $1.98 per unit

fixed operating costs = $6,010

Interest = $10,130 per year

W sales = 103,000 units

sales cost = $2.54 per unit

variable operating costs = $0.96 per unit

fixed operating costs = $62,500

Interest = $17,400 per year

tax bracket. = 40%

solution

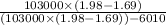

degree of operating R =

degree of operating R = 1.25

and

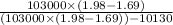

degree of financial =

degree of financial R = 1.51

and

total leverage for firm R = 1.25 × 1.51

total leverage for firm R = 1.88

and

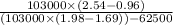

degree of operating W =

degree of operating W = −4.98

and

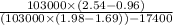

degree of financial W =

degree of financial W = 13.05

and

total leverage for firm W = -4.98 × 13.05

total leverage for firm W = −64.989

and

Firm W has more fixed costs and therefore more operational risk.

and for overcome risk it have to achieve profit by increasing sales price and reduce variable operating cost.

so

Finance risk is more for Firm W as it has more interest to pay

and

Leverage is the use of fixed costs in a company’s cost structure.