Question is Incomplete;Complete question is given below;

Brian's gross earnings for the week of July 8, 2019, are $1227.38. His deductions comprise 23% of his total compensation.

What is his net pay?

Enter the answer to the nearest hundredth, such as $1234.56.

Answer:

Brian's Net pay is $945.08.

Explanation:

Given:

Gross earnings for the week = $1227.38

Deductions = 23%

We need to find the net pay.

Solution:

First we will find the amount deducted.

amount deducted is equal to Deductions on Gross pay.

framing in equation form we get;

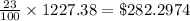

amount deducted =

Now we can say that;

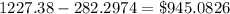

Net pay is equal to Gross earnings minus amount deducted in tax.

framing in equation form we get;

Net pay =

Rounding to nearest hundred we get;

Net pay = $945.08

Hence Brian's Net pay is $945.08.