Answer (A):

Need more data to select the better adviser

Explanation:

Adviser A averaged 19% return on the investment which is more than that of Adviser B who averaged 16% return on investment. However, adviser A has a beta of 1.5 which is also greater than that of Adviser B who has a beta of 1. This means that adviser A made a more riskier investment and hence a higher average return on investment. We need more data to tell which adviser performed better in relation to each other.

Answer (B):

Investment Adviser B

Step-by-step explanation:

= T-bill rate = 6%

= T-bill rate = 6%

= Market return = 14%

= Market return = 14%

= Market risk premium = 14% - 6% = 8%

= Market risk premium = 14% - 6% = 8%

= Average Return by Adviser A =19%

= Average Return by Adviser A =19%

= Beta of Adviser A = 1.5

= Beta of Adviser A = 1.5

= Average Return by Adviser B =16%

= Average Return by Adviser B =16%

= Beta of Adviser B = 1

= Beta of Adviser B = 1

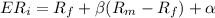

CAPM Equation is

For Adviser A

= 6 + 1.5 (14 - 6) = 18%

= 6 + 1.5 (14 - 6) = 18%

The expected average return for the investment is 18% which means that Adviser A over performed the market by 1 %

For Adviser B

= 6 + 1 (14 - 6) = 14%

= 6 + 1 (14 - 6) = 14%

The expected average return for the investment is 14% which means that the Adviser B over performed the market by 2 %

Clearly, Adviser B performed better than Adviser A.

Answer (C):

Adviser B

Step-by-step explanation:

In this part, the

and

and

All else remains the same

We make similar calculation as in part B