Answer:

WACC = 7.89%

Step-by-step explanation:

Lets find "cost of equity" first.

The formula is:

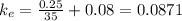

Which is basically the next year dividend divided by stock price summed with growth rate. So cost of equity is:

Now, "cost of debt":

Formula is:

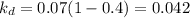

Which is the yield to maturity times "1 - tax rate", so it will be:

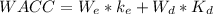

WACC formula is:

Where

W_e is weight of equity, which is 45/(45+10) = 45/55 = 9/11

W_d is weight of debt, which is 10/(45+10) = 10/55 = 2/11

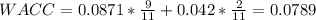

Now, wacc is:

In percentage, 0.0789 * 100 = 7.89%

WACC = 7.89%