Answer:

2.7%.

Step-by-step explanation:.

Given:

Net profit margin ( profitability rate) = 15%

Total sales = $155 million

Total assets = $312 million

Total equity = $223 million.

Dividend rate = 10%

Question asked:

What is the firm's sustainable growth rate ?

First of all we will find these thing.

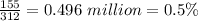

1. Asset utilization rate =

=

2. Financial utilization rate =

Total debt = Total asset - Total equity

= $312 million - $223 million = $89 million

=

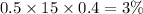

3. Return on equity rate = Asset utilization rate

profitability rate

profitability rate

Return on equity rate =

4. Business retention rate = 100 - Dividend rate

= 100 - 10 = 90%

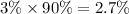

Now, finally we will calculate sustainable growth rate :

Sustainable growth rate = Return on equity rate

Business retention rate

Business retention rate

=

Therefore, firm's sustainable growth rate is 2.7%