Answer:

the bond's price elasticity = - 0.67

Step-by-step explanation:

present bond value = $1100

previous bond value = $900

change in bond value = $1100 - $900 = $200

present bond percentage = 8%

previous bond percentage = 12%

% change in bond value = 8% - 12% = - 4%

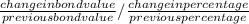

Bond price elasticity =

=

=

= - 0.67