Solution:

Next year, we have to find the dividend for a stock with super normal growth in this region. We believe the stock price, the growth rate of the dividends and the expected yield, but not the dividend. First of all, we need to remember that in year 3 the dividend is the FVIF dividend.

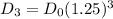

The dividend in Year 3 will be:

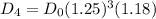

And the dividend in Year 4 will be the dividend in Year 3 times one plus the growth rate, or :

The portfolio is continuously growing in year 4, which is why it is split by the demanded return minus the growth rate in year 4 as the dividend in year 5.

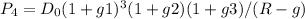

The equation for the price of the stock in Year 4 is:

Now we can substitute the previous dividend in Year 4 into this equation as follows:

(1.25)3(1.18)(1.08) / (0.15 − 0.08) = 69.86

(1.25)3(1.18)(1.08) / (0.15 − 0.08) = 69.86