Answer:

Company A will pay $16,000 and Company B will pay $8,000.

Step-by-step explanation:

Pro rata method means allocating the amount to each company according to their percentage amount.

Here in this case,

Total Insurance amount = $100,000+50,000 = $150,000

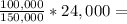

Company A share if $24,000 loss occurs:

=

$ 16,000

$ 16,000

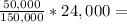

Company B share if $24,000 loss occurs:

=

$ 8,000

$ 8,000

Hence , Company A will pay $16,000 and Company B will pay $8,000.