Answer:

Public good is a good which is non-rival and non-exclude able in nature. For example water, sun-rays, lighthouses, streetlights etc

It is non-rival in the sense that the consumption of the good by one does not decrease the consumption of other people in the society.

It is non-exclude, which means that nobody can be excluded from the use of the good or the service It is difficult to exclude them

Externality occurs when the action of an individual or a firm affects other individuals or firms in an economy in either a positive or a negative way.

The relevant benefits or costs (compensation of externality) are not reflected in the market prices

Externalities arise in case of public goods because of the problem of .free-rider. This means that the benefits of the good are reaped by some other party without paying for the good.

In this case, private firms fail to provide the good because people do not reveal their true preferences. Thus,market failure occurs in case of production of public goods because of the presence of positive or negative externalities

The government steps up to produce this good when market fails to produce it by

charging each persona price equivalent to their marginal willingness to pay for the good.

Marginal social cost (MSC) of a good is the minimum amount of money required to compensate the producers to make them produces an extra unit of that good and make it available for consumers.

It is the change in the total social cost of production due to the production of an additional unit of output

Marginal social benefit (MSB) of a good is the maximum amount of money that people need to give up to obtain an additional unit of the good

It is the extra benefit derived from the availability of an additional unit of the good It includes private benefits as wen as external benefits such as benefits of a positive externality.

Suppose few shops in the shopping center benefit from the security lights in the parking lot La this case, the benefits of the positive externality are reflected in the prices.

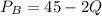

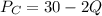

The demand functions, reflecting marginal willingness to pay of each store, are given as follows

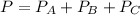

The market quantity is fixed in case of a public good. However, the price of the good needs to be calculated The price to be charged for a public good is the sum of marginal willingness to pay of each store at each quantity level (Q)

That is,

P = (50 - Q) + (45 - 2Q) + (30 - 2Q)

P = (50 + 45 + 30) - (Q + 2Q + 2Q)

P = 125 - 5Q

This is the marginal social benefit (demand) function for the public good

A firm equates its MSB with Sac to maximize the difference between total social benefit and total social cost The intersection of MSB and MSC curves gives the market equilibrium price and quantity.

MSC is $70 per security light.

MSB = MSC

125 - 5Q = 70

125 - 70 = 5Q

55/5 = Q

Q = 11

Thus, the socially efficient output quantity of lights is 11 security lights