Answer:

Net present value = $2063.1922

Step-by-step explanation:

given data

initially costs = $40,500

cash flows = $34,500

final cash inflow = $12,000

required rate of return = 18.5 percent

solution

The cash flows is

Year 0 = $40500

Year 1 = $0

Year 2 = $0

Year 3 = $34500

Year 4 = $34500

Year 5 = $0

Year 6 = $12000

so Net present value will be express as

Net present value = -Initial cash outflow + Present value of future cash flows ...............1

Present value of future cash flows = (cash flow in year n) ÷ (1 + required rate of return)^t ..........................2

put here value we get

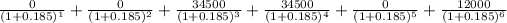

Present value =

Present value = $42563.1922

Net present value= -$40500 + $42563.1922

Net present value = $2063.1922