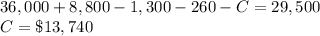

Answer:

$13,740

Step-by-step explanation:

In the perpetual method of inventory valuation, the inventory balance is updated constantly after each transaction. In this problem, the initial balance is $36,000, purchases of new inventory will increase the balance, while returns, discounts and goods sold will decrease the balance. If the ending inventory is $29,500, the cost of goods sold (C) is determined as:

The cost of goods sold was $13,740.