Answer:

$6666

Step-by-step explanation:

Given:

Direct materials = $ 2,483

Direct labor-hours = 77 hours

Direct labor wage rate = $ 19 per labor-hour

Machine-hours = 136 hours

The predetermined overhead rate = $20 per machine-hour.

Solution:

To find the total cost , we will add the following cost: Direct materials cost, Direct labor cost, Machine using cost

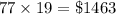

Direct labor cost = Direct labor-hours

Direct labor wage rate

Direct labor wage rate

Direct labor cost =

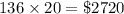

Machine using cost = Machine-hours used

predetermined overhead rate

predetermined overhead rate

Machine using cost =

Total cost = $ 2,483 + $1463 + $2720 = $6666

Therefore, The total cost that would be recorded on the job cost sheet for Job 910 would be $6666